Entertainment & Lifestyle

Actor Ajith Casts Vote For Tamil Nadu Lok Sabha Elections2024 From Tiruvanmiyur Polling Booth

The Dark Side Of 'Influencer' Diets: Experts Call Out Health Influencers

Divyanka Tripathi Breaks Two Bones As She Meets With Accident, Rushed to Hospital

Maidaan Box Office Collection Day 8: Ajay Devgn's Sports Drama Kicks Its Way to Success

MET Gala 2024: Theme, Ticket Price, Co-Chairs And Guest List

Bigg Boss OTT 3: Elvish Yadav, Manisha Rani, Abhishek Malhan To Turn Mentors?

Maidaan Actor Amartya Ray Defends Film Not Being Dubbed In Bengali: If You Go Deeper Into Language Politics... | Exclusive

Adil Hussain REACTS After Sandeep Slams Him For 'Regretting' Kabir Singh | EXCL

Trending:

- MET Gala 2024: Theme, Ticket Price, Co-Chairs And Guest List

- Most Popular Books Banned in School Libraries

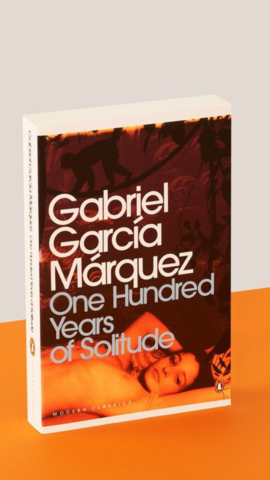

- From Shadow and Bone to One Day, 5 Book Adaptations to Watch This Weekend

- 8 Pilgrimage Destinations In India To Visit This Summer

- Things Parents Should Consider Before Posting About Their Child Online

- 8 Best Brunch Places To Visit In Delhi For A Delicious Weekend Meal

- Priyanka Chopra's Secret DIY Recipe For The Glowing Skin

The History Of Boli In Thiruvananthapuram And Why It's So Popular

The History Of Boli In Thiruvananthapuram And Why It's So Popular The Princess From Mysore Who Became The Face Of Smallpox Vaccine

The Princess From Mysore Who Became The Face Of Smallpox Vaccine The Dark Side Of 'Influencer' Diets: Experts Call Out Health Influencers

The Dark Side Of 'Influencer' Diets: Experts Call Out Health Influencers 10 Signs Your Eyesight Is Getting Worse: What You Need To Know

10 Signs Your Eyesight Is Getting Worse: What You Need To Know Chef Asma Khan Makes To The List of 100 Most Influential People 2024 List

Chef Asma Khan Makes To The List of 100 Most Influential People 2024 List

Trending:

Trending:

Love Sex Aur Dhokha 2 Movie Review: Dibakar Banerjee's Sequel Of Interconnected Stories Pulls, Pushes In Too Many Directions

Love Sex Aur Dhokha 2 Movie Review: Dibakar Banerjee's Sequel Of Interconnected Stories Pulls, Pushes In Too Many Directions- Rajinikanth Shares First Message After Casting His Vote: There Is Respect And Dignity In Voting So...

- RR Kabel Filmfare Awards Marathi 2024 Winners: Shashank Shende Bags Best Actor, Suhas Joshi Wins Lifetime Achievement. Full List

- Do Aur Do Pyaar Movie Review: Vidya Balan, Pratik Gandhi Delve Into The Depths Of Relationship In This Modern Drama

- Maidaan Actor Amartya Ray Defends Film Not Being Dubbed In Bengali: If You Go Deeper Into Language Politics... | Exclusive

- Sanjay Kumar Singh, NCB Director General Who Cleared Shah Rukh Khan's Son Aryan Khan's Name In Drugs-On-Cruise Case, Takes VRS

- Divyanka Tripathi Breaks Two Bones As She Meets With Accident, Rushed to Hospital

- Aditya Deshmukh: ‘I Rejected Ranbir Kapoor’s Ramayana Because…’ - Exclusive

- The Witcher Season 4 Begins Production, Liam Hemsworth And Anya Chalotra Starrer To End With Fifth Season

- Actor Ajith Casts Vote For Tamil Nadu Lok Sabha Elections2024 From Tiruvanmiyur Polling Booth

- Kajol's Pre-Birthday Post For Nysa Is A Testament To Their Strong Bond: 'She Makes Me Happy...'

Troll Asks Harsh Varrdhan Kapoor To Stop Blowing Up Dad Anil Kapoor's Money And Do A Decent Film, Actor's Response Is Hilarious

Troll Asks Harsh Varrdhan Kapoor To Stop Blowing Up Dad Anil Kapoor's Money And Do A Decent Film, Actor's Response Is Hilarious Remembering The Unforgettable Surekha Sikri On Her Birth Anniversary

Remembering The Unforgettable Surekha Sikri On Her Birth Anniversary Actor Vijay Returns On Time To Chennai To Cast Vote In Parliamentary Elections 2024

Actor Vijay Returns On Time To Chennai To Cast Vote In Parliamentary Elections 2024 Bigg Boss OTT 3: Elvish Yadav, Manisha Rani, Abhishek Malhan To Turn Mentors?

Bigg Boss OTT 3: Elvish Yadav, Manisha Rani, Abhishek Malhan To Turn Mentors? 11 Years Of Ek Thi Daayan: Director Kannan Iyer Says 'With Brilliant Emraan Hashmi Coming On board, The Film Was On A Solid Wicket' | EXCLUSIVE

11 Years Of Ek Thi Daayan: Director Kannan Iyer Says 'With Brilliant Emraan Hashmi Coming On board, The Film Was On A Solid Wicket' | EXCLUSIVE

Trending:

Lok Sabha Polls 2024: Why Western UP Is Politically Significant For Parties

Principal Caught Taking Facial In UP School, Bites Teacher Who Confronted Her | Video

Lok Sabha Polls 2024: Rebuked For 'Shooting Arrow' At Mosque, BJP Candidate Says...

Lok Sabha 2024 Elections: Top 10 Battles In Phase 1 That Would Grab Eyeballs

AAP's Amanatullah Khan Not Arrested, Was Questioned By ED For Over 12 Hours

'Every Voice Matters': PM Modi's Vote In 'Record Numbers' Request To Voters As Lok Sabha Polls Begin

Who Is Dinesh K Tripathi, Indian Navy's New Chief of Naval Staff?

Lok Sabha Elections 2024 To Kickstart Today With Polling Across 102 Constituencies In Phase 1

NCB Vs Sameer Wankhede Gets Murkier, DDG Sanjay Singh ‘VRS’ Adds Twist, Sapna Pabbi's Name Emerges

5 Workers Trapped After Two-Storey House Collapses In Punjab, Rescue Ops Underway | Video

Who Is Amanatullah Khan? AAP MLA Likely To Be Arrested In Waqf Board-Linked Money Laundering Case

VIDEO: Part Of Mehtar Mahal Collapses Due To Lightning, Damages Car In Karnataka's Vijayapura

Indians In Dubai ALERT! Don't Miss This Important Advisory Amid Floods, Check Helpline Numbers

Upma Served By IndiGo Has More Sodium Than Maggie? Airline Responds To Influencer's Viral Video

Trending:

Trending:

Trending:

Brothers Hacked In Front Of Eyes, Boy, 10, Shares Chilling Details Of UP Double Murder

Delhi Police Recovers Body Of ACP'S Missing Son From Haryana's canal

15-Year-Old Rape Survivor Hangs Herself After She Was Found Pregnant

'Paisa Utha Lo': Crash Victim Dies As Bystanders Debate Whether To Help Him Or Loot His Rs 1.5 Lakh Cash

2024 Toyota Fortuner Debuts With Mild-Hybrid Powertrain; Here's What Changed

Watch Lewis Hamilton Tear Up The Streets Of Japan In A Nissan GTR R34

2024 Toyota Land Cruiser 250 Series Launched In Japan Along With Two Special First Edition Models

HMSI Inaugurates Engine Assembly Line At Manesar Plant In Haryana

Trending:

Aries

Mar 21-Apr 20

Taurus

Apr 21-May 21

Gemini

May 22-Jun 21

Cancer

Jun 22-Jul 22

Leo

Jul 23-Aug 23

Virgo

Aug 24-Sep 22

Libra

Sep 23-Oct 23

Scorpio

Oct 24-Nov 22

Sagittarius

Nov 23-Dec 21

Capricorn

Dec 22-Jan 20

Aquarius

Jan 21-Feb 18

Pisces

Feb 19-Mar 20

Trending:

Satyanarayan Puja 2024: Know the Puja Vidhi, Rituals and its Significance

Mahavir Jayanti 2024: Know the History, Celebrations and Significance of This Day

Navratri 2025: Mother Durga Bid Farewell Riding on this Vehicle, Which Vehicle Will She Come Next Year?

Mother Goddess is Worshiped with Sticks in This Temple, a 750 Year Old Tradition, Know the History

Trending:

Trending: